Feie Calculator - An Overview

Wiki Article

Feie Calculator - Questions

Table of ContentsHow Feie Calculator can Save You Time, Stress, and Money.Some Ideas on Feie Calculator You Should KnowTop Guidelines Of Feie CalculatorFeie Calculator Can Be Fun For AnyoneFascination About Feie Calculator

He sold his U.S. home to establish his intent to live abroad permanently and used for a Mexican residency visa with his wife to aid fulfill the Bona Fide Residency Test. Neil directs out that getting residential property abroad can be challenging without very first experiencing the location."It's something that people require to be truly attentive about," he claims, and recommends expats to be careful of typical mistakes, such as overstaying in the U.S.

Neil is careful to stress to U.S. tax authorities tax obligation "I'm not conducting any business any kind of Company. The U.S. is one of the few nations that tax obligations its citizens regardless of where they live, indicating that also if a deportee has no revenue from United state

tax return. "The Foreign Tax obligation Credit rating enables individuals functioning in high-tax countries like the UK to counter their United state tax obligation liability by the quantity they've currently paid in taxes abroad," states Lewis.

The Of Feie Calculator

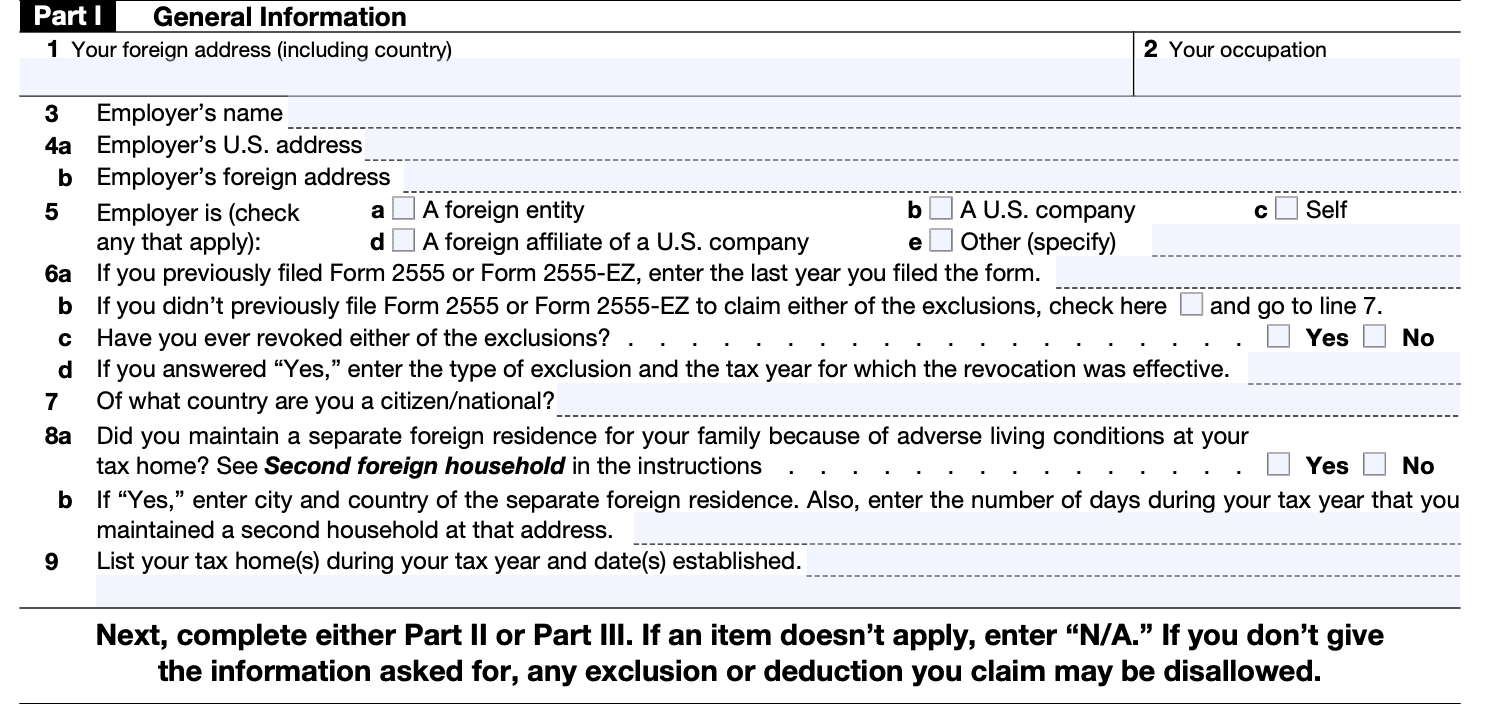

Below are a few of one of the most often asked inquiries regarding the FEIE and other exemptions The International Earned Earnings Exemption (FEIE) allows united state taxpayers to omit up to $130,000 of foreign-earned income from federal earnings tax obligation, lowering their united state tax obligation responsibility. To get FEIE, you must satisfy either the Physical Presence Test (330 days abroad) or the Bona Fide House Test (confirm your key house in an international nation for a whole tax year).

The Physical Presence Test needs you to be outside the united state for 330 days within a 12-month duration. The Physical Visibility Test additionally calls for U.S. taxpayers to have both a foreign revenue and an international tax home. A tax obligation home is defined as your prime location for business or employment, no matter your household's home.

Feie Calculator Fundamentals Explained

An income tax obligation treaty between the united state and another nation can help stop dual taxation. While the Foreign Earned Revenue Exclusion minimizes gross income, a treaty might offer extra benefits for eligible taxpayers abroad. FBAR (Foreign Bank Account Report) is a required declaring for U.S. people with over $10,000 in foreign financial accounts.Eligibility for FEIE depends on meeting certain residency or physical presence examinations. He has over thirty years of experience and now specializes in CFO solutions, equity compensation, copyright taxation, cannabis taxation and separation related tax/financial planning issues. He is a deportee based in Mexico.

The foreign gained revenue exemptions, occasionally referred to as the Sec. 911 exemptions, exclude tax obligation on incomes gained from functioning abroad.

Feie Calculator Things To Know Before You Buy

The tax benefit omits the income from tax at bottom tax rates. Previously, the exemptions "came off the top" lowering earnings topic to tax at the leading tax rates.These exclusions do not excuse the salaries from United States taxation yet simply give a tax obligation decrease. Note that a single person working abroad for every one of 2025 who gained concerning $145,000 without any other revenue will certainly have gross income reduced to zero - effectively the same response as being "free of tax." The exemptions are computed on an everyday basis.

Report this wiki page